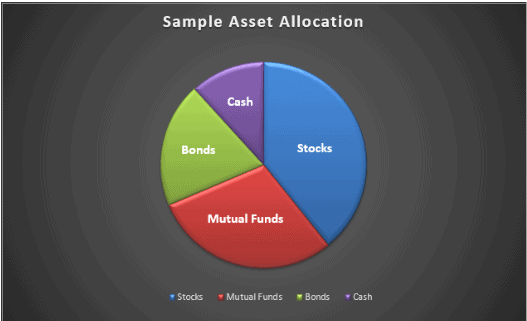

An investment portfolio is a group of assets in which an investor invests, expecting benefits in future. A wise investor will not put all his investments in one basket. He/she will try to split up their investments in various assets to reduce the risk associated. Investment portfolios can be structured by individuals depending on their needs. Every investment plan is different catering to the need of an individual. Here are a few things that you need to know about investment portfolios.

Components of an investment portfolio

A) Stocks

The most common component of an investment portfolio is stock. Stocks are nothing but shares of a particular company. An investor who owns stock in a firm is its part-owner. The level of ownership depends on the number of stocks he possesses. This can be advantageous because, in who the company gains a profit, it is shared with all its owners. The profit is shared with the investors, depending on the number of shares. Investors who expect benefits in the short term can also sell these stocks depending on the company’s performance. i.e., stocks bought at a lower price can be sold out for a higher price, when the company performs well. Stocks are considered to be risky, as it is completely dependent on the functioning of the firm in which the investment is made.

B) Bonds

Bonds are safer ways of investing money. At the same time, they come with lower benefits when compared to stocks. Bonds work much similar to a lending process. In the case of bonds, an investor lends his money to the government or a firm or an agency. The bond comes with a “Maturity date”. The maturity date is the date in which, the loanee or borrower has to return the principal amount borrowed, along with the interest. Bonds work on a fixed interest rate and do not fluctuate much. This is why the level of risk involved is less.

C) Cash

This includes regular bank deposits. They provide the least profit values among all investment options available. At the same time, they are also advantageous, with very low or no risk. Bank deposits ensure regular income but they offer no chance of capital growth. Cash is generally used as a protective measure in an investment portfolio.

D) Property or Real estate

Properties like land or real estate, belong to the growing investment category. This is because the prices of land or buildings shoot up over a while. This type of investment is suitable for medium-term or long term investors. However, there are also risks associated with real estate. They can fall in value and may lead to losses in a few cases. Hence, the investor has to consider the location and nature of the property before investing.

All these portfolios fall under three major class

- Growth portfolio is related to young and budding companies, that possess the potential to grow. Investing in such companies is risky indeed. But if the company turns out to be successful, the profit out of it is high. The investor has to keenly analyze the functioning and efficiency of the firm before investing.

- Income portfolio an income portfolio involves less risk when compared with a growth portfolio. This includes buying stocks from a well-established firm. This type of portfolio is more towards gaining regular incomes from the investments and not towards potential capital gains. They are also called as defensive investments as they generate regular income.

- Value portfolio Under an economic crisis, when firms struggle to survive, investors lookout for potential firms that are priced low because of the crisis. The firms which have a very high-profit potential are picked by investors as value portfolios. These portfolios are chosen for investment based on the fair market value. Hence, this requires a higher level of understanding and analysis to identify the efficiency of the firm in which the investment is to be made.

Approaches in investment portfolios

There are two major approaches that investors follow to gain benefits from investments. This includes,

- Strategic investment

This is best suited for investors with a long term approach. In strategic investment, an investor holds the asset for several years. Investors use investments that have long term growth potential under the strategic approach to gain maximum profit.

B) Tactical approach

This is suited for investors with a short-term investment plan. In this, the investors buy and sell assets frequently to gain small profits. This is a repetitive cycle, each time a new investment is made, and when the price of the asset rises, it is sold off. The difference between the buying and selling price makes up the profit for an investor.

Things to consider when building an investment portfolio

1.Objective

When constructing a plan for investment, the investor should have a clear idea of the objective. The objective will help in determining the duration of the investment plan. After which the investor can choose appropriate assets depending on the duration. Bonds usually fall under long term investment. Whereas stocks, real estate or gold can be bought or sold according to the duration planned by the investor.

2. Transaction frequency

Investors who rely more on short term benefits perform more transactions. This frequent buying and selling process costs more. The transaction cost involved in frequent buying and selling sometimes is on par with the profit earned. Hence, investors have to take into consideration, the transaction cost before buying and selling. This is a major problem associated with the stock market, where the frequency of transactions is very high.

3. Relying on a single investment

Investors worry too much about the risks involved in investment portfolios. The best way to safeguard or protect your investment is to diversify your investment. This is because, if one of your investment assets fail to generate profit, the other asset would compensate for it. Be wise in building a perfect investment plan by splitting up your investment amount.

4. Frequent monitoring

Once you have built a plan and made the investment, you need o keep an eye on your investments. Check from time to time if the performance of your asset is on par with your expectation. If you find your plan is not working efficiently, then you need to work on making a new plan. This has to be performed regularly to come out with a decent profit. Prepare an alternative plan well in advance to escape critical situations.

There are a few factors that one has to consider before choosing an asset for investing

- Willingness to take risk

Investment plans are not always profitable. It involves a high level of risk factor. One has to take the risk to swim across the ocean called investment. With increased risk comes increased benefits. Keep this in mind before building a plan. Always have sufficient backups to escape the mishaps.

B) Time

While jotting down a plan, make sure you fix up a time frame for your investment plan. The duration of your investment plan is a critical factor. Choose an asset that has the possibility of giving you your expected returns within the expected time frame. This will help you choose the asset in which you need to invest.

C) Returns expected

There are a few assets that perform better than the others. Depending on the returns you expect, you can choose assets. It is wise to remember that, more benefit comes with more risk. All these factors are interconnected. One has to consider all these factors while choosing assets for investment.

By using these basic components, one can prepare a proper investment plan. Consider all these factors wisely before investing. Watch out for expert opinions while taking crucial decisions. You can also refer to your past experiences and consider them before making or changing the plan. All this will help you eliminate the risk involved in an investment. Not all investment stories have a bad ending. With a clear plan and experience, you could become one among the successful investors.